Three checks, one solution

Triplecheck

INTRODUCING TRIPLECHECK

The most robust & reliable Digital Identity solution

TripleCheck is the only Customer Identification Program you need from AML leaders SmartSearch.

This innovative technology combines our three most sophisticated verification, facial recognition, and anti-fraud techniques to create a unique three-steps in one BSA/AML solution.

- Level 1: Verifying Identity with Sanction and PEP screening

- Level 2: Facial Recognition, Document Capture and Liveness Appraisal

- Level 3: Digital Fraud Checks with Data Referencing and Triangulation

How does it work?

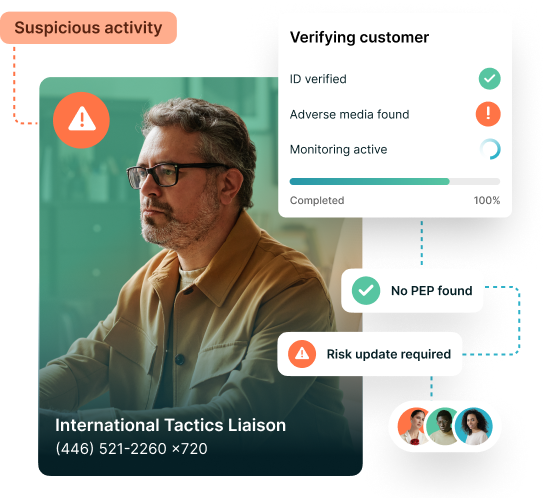

LEVEL 1

Verify identity & screen for Sanctions and PEPs

Level 1 of TripleCheck is a full identity check with Sanction and PEP screening.

Just enter the customer’s details into the system and we will verify the individual using global credit reference agency data.

Each check is screened against more than 1,100 global watchlists and enhanced due diligence is automatically triggered on any matches. Our advanced AI automatically resolves almost all false positives and continues to monitor all searches daily to ensure you remain compliant.

A full report will be produced for every check, detailing the results of the screening, and evidence that it has been performed.

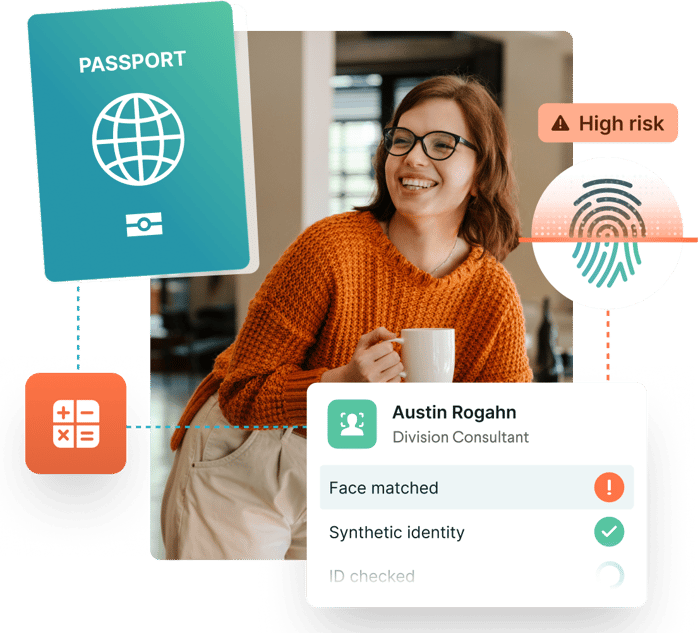

LEVEL 2

Facial Recognition, Document Capture and Liveness Appraisal

Level 2 of TripleCheck uses Optical Character Recognition (OCR) and the latest biometric facial recognition techniques to gain an accurate picture of your customer.

By performing an algorithmic check on their driver's license, social security card, or passport, and capturing a 'real-life' image via a Selfie Liveness Video (SLV) the technology is able to utilize liveness detection to ensure the information provided is genuine and that the customer and the ID they have provided match.

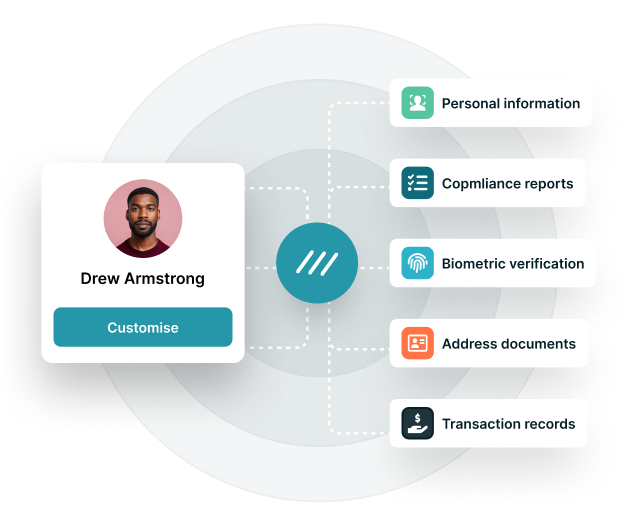

LEVEL 3

Digital Fraud Checks, Data Referencing and Triangulation

Level 3 of TripleCheck uses Digital Elements (DEs) to create easy to understand fraud risk indicators. It then uses advanced anti-fraud technology to deliver an overall risk score and, via a dashboard, provides all the information needed to support any additional due diligence.

Once the fraud check is complete, the TripleCheck technology uses triangulation to match the DEs with the individual’s terrestrial address to enable all the information to be bound together to create a Composite Digital Identity (CDI).

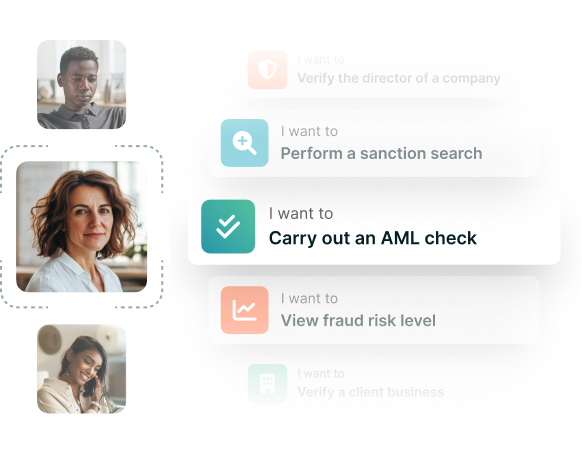

WHAT WE DO

TripleCheck - a unique AML solution

By triangulating terrestrial data verification and Sanction and PEP screening, with OCR, facial recognition, and liveness detection and, finally, digital fraud checks, SmartSearch has created a unique global AML solution.

You will never need to use separate Customer Identification Program, compliance, and anti-fraud providers, because SmartSearch has combined all the latest verification, monitoring and biometrics anti-fraud techniques to create TripleCheck, the most powerful and effective all-in-one solution on the market.

HOW WE DO IT

Easy to use, all-in-one process

While the technology behind TripleCheck is highly advanced, the interface and outcomes have been designed with the user in mind, meaning team members at any level can successfully perform a SmartSearch TripleCheck.

A full report is automatically produced and stored on the central SmartSearch platform ensuring evidence of the check is always available, while our ongoing monitoring will check each record daily to ensure you remain compliant.

See it in action

Let one of our highly-trained sales team demonstrate the multi-award winning SmartSearch AML product.