AML Monitoring and Reporting

AML (anti-money laundering) monitoring and reporting is a key part of your AML checks, ensuring complete compliance with the law. Our AML reporting system ensures you have all the information needed to make those tough decisions, providing ongoing monitoring throughout the year.

Find out more and speak to a member of our expert team today.

Suspicious activity reporting has never been easier

Instant AML reports

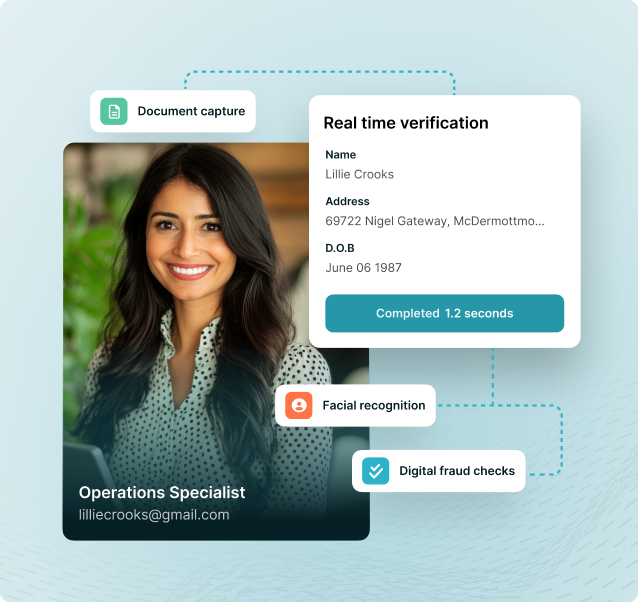

Our AML suspicious activity reports are automated and conducted in real-time, ensuring you always have the information you need, when you need it.

Our AML suspicious activity reports are automated and conducted in real-time, ensuring you always have the information you need, when you ...

A centralised compliance process

When using SmartSearch, all your AML checks and reports are conveniently located in the same platform, making the overall process much more cost-effective and efficient.

When using SmartSearch, all your AML checks and reports are conveniently located in the same platform, making the overall process much more ...

Monitoring at your own pace

Every business is different, meaning you’ll likely want to run your AML audit reports at different times. Checks can be carried out as you need them, providing greater control over your business.

Every business is different, meaning you’ll likely want to run your AML audit reports at different times. Checks can be carried out as you ...

Supported by the Dow Jones Factiva Watchlist

Our monitoring service is supported by the Dow Jones Factiva Watchlist database, comprising over 1,100 worldwide Sanctions and PEP lists to ensure full compliance for your brand.

Our monitoring service is supported by the Dow Jones Factiva Watchlist database, comprising over 1,100 worldwide Sanctions and PEP lists to ...

The main features of our monitoring and reporting solution

Reporting suspicious activity was once a difficult task, especially when using manual reporting and monitoring processes. However, by using SmartSearch, you can make the process much more efficient, saving your organisation both time and money in the long run.

At SmartSearch, we understand that every situation is different, so you’ll likely have different reporting guidelines and monitoring time frames in mind when compared to other businesses. Regardless of your setup or the industry you work in, we can offer your company the following features when you use our software.

Whichever package you choose to go for, we’ll be happy to help - just get in touch to find out more.

/SmartSearch_OfficeLifestyle_Feb25_095%201-1.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_095%201-1.jpg)

Why should you use SmartSearch for your AML reporting?

At SmartSearch, we’re an award-winning company offering several solutions for businesses aiming to prevent money laundering and other forms of financial fraud from occurring within their organisation.

Let's take a look at why we think you should choose SmartSearch for your AML transaction monitoring software...

/SmartSearch_OfficeLifestyle_Feb25_042.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_042.jpg)

/SmartSearch_OfficeLifestyle_Feb25_019.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_019.jpg)

/SmartSearch_OfficeLifestyle_Feb25_001%201.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_001%201.jpg)

/SmartSearch_OfficeLifestyle_Feb25_029.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_029.jpg)

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.

Key features of our AML checks and monitoring software

There are several key features you should be aware of before committing to SmartSearch for your AML checks and monitoring services, offering a wide range of benefits for modern businesses and organisations.

Want to see how it all works? Book a demo today!

-

/SmartSearch_OfficeLifestyle_Feb25_086.jpg?width=462&height=293&name=SmartSearch_OfficeLifestyle_Feb25_086.jpg)

Full integration with existing systems

The SmartSearch platform effortlessly integrates with your existing systems and workflows, making the compliance process much smoother and easier to run.

-

/SmartSearch_OfficeLifestyle_Feb25_089.jpg?width=462&height=293&name=SmartSearch_OfficeLifestyle_Feb25_089.jpg)

A user-friendly dashboard

We provide an intuitive interface and dashboard to allow easy navigation and access to essential information and reports, making our platform easy to use.

-

/SmartSearch_OfficeLifestyle_Feb25_059.jpg?width=462&height=293&name=SmartSearch_OfficeLifestyle_Feb25_059.jpg)

Have an audit trail for record keeping

Keeping records is paramount for businesses wanting to avoid financial fraud. At SmartSearch, we always maintain a comprehensive and compliant audit trail for all activities carried out through our system, simplifying regulatory inspections and audits.

-

/SmartSearch_OfficeLifestyle_Feb25_063.jpg?width=462&height=293&name=SmartSearch_OfficeLifestyle_Feb25_063.jpg)

Ongoing support and updates

You’ll always receive ongoing support and updates when using our AML software, ensuring your business is always compliant with current AML regulations and requirements.

There’s a reason over 7,000 clients put their trust in us

The onboarding process has allowed us to enhance our user experience, whilst improving compliance oversight without the need for manual intervention.

Audit & Compliance Manager, Acasta Europe LimitedThe ease and efficiency of the AML checks made SmartSearch really stand out. We were particularly impressed with the automatic reporting feature that instantly downloaded to the back-office system to deliver a full audit-trail of our clients.

Arena Investment ManagementThe SmartSearch system is easily accessible and very user-friendly. Customer service is excellent and any queries are met with a very quick and knowledgeable response.

Karen Hogan, Thorntons InvestmentsServing professional AML regulated industries

Trusted by over 7,000 regulated businesses, SmartSearch's next-generation technology is the UK's leading solution for AML and risk management.

Ensuring Solicitors and Legal firms are AML compliant

- Benefit from industry-leading pass rates

- Enhance client relationships

- Protect your reputation

- Reduce compliance risk

Innovative AML solutions for Accountants

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

AML checks for Estate Agents & Property companies

- Experience hassle-free AML and compliance

- Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

- Streamline your onboarding process

Delivering AML compliance for Financial Services firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

-

Experience hassle-free AML and compliance

AML technology for Investment Banking

-

Benefit from industry-leading pass rates

- Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Insurance firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

- Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

Innovative AML solutions for Gaming firms

Ensure safe gaming for your organisation with SmartSearch’s all-in-one AML platform.

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance for Banking organisations

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML solutions for Cryptocurrency firms

-

Benefit from industry-leading pass rates

-

Accelerate your customer onboarding without compromising on compliance

-

Deliver a frictionless customer journey

- Experience hassle-free AML and compliance

AML and compliance technology for Property Development firms

-

Experience hassle-free AML and compliance

-

Benefit from industry-leading pass rates

- Deliver a frictionless customer journey

-

Streamline your onboarding process

/SmartSearch_OfficeLifestyle_Feb25_136.jpg?width=951&height=633&name=SmartSearch_OfficeLifestyle_Feb25_136.jpg)

Automated monitoring ensures effortless compliance

Our reporting and monitoring software makes AML compliance much easier than conducting your own manual checks, ensuring your business always complies with AML reporting requirements. Essential tasks such as sanctions, PEP and RCA screening can be carried out with ease, helping your organisation stay ahead of regulatory changes and effectively mitigate risk when required.

Find out more about our other AML solutions here.

/SmartSearch_OfficeLifestyle_Feb25_115%201.jpg?width=951&height=633&name=SmartSearch_OfficeLifestyle_Feb25_115%201.jpg)

What is AML monitoring and reporting?

AML monitoring and reporting is an important part of the AML check process, ensuring your business always complies with AML regulations:

- AML monitoring: Ongoing AML monitoring is the process of observing financial transactions, customer behaviour and relevant risk profiles,, attempting to identify unusual behaviour or suspicious activity like large cash transactions.

- AML reporting: Once suspicious activity has been identified, your business will be required by law to complete reports (such as SARs - suspicious activity reports), informing regulatory authorities of the activity so they can investigate themselves.

Essentially, AML monitoring and reporting are two linked activities, essential for maintaining regulatory compliance and combating financial crime around the globe.

Learn more about our AML checks here.

/SmartSearch_OfficeLifestyle_Feb25_063.jpg?width=951&height=633&name=SmartSearch_OfficeLifestyle_Feb25_063.jpg)

Training provided for your team

At SmartSearch, we can also offer full training for your team, ensuring they understand how to address and mitigate business risks. We offer flexible tailored training packages to educate your staff about the risks of money laundering, red flags and just how important AML compliance is.

Stay up to date with the latest AML regulation changes

If you’d like to keep up to date with the latest AML regulation changes, you can view our insightful blog, providing you with a series of helpful guides that will make incorporating our platform into your company as simple as possible.

Frequently asked questions

If you still have questions after reading through this page, please explore our FAQS below or feel free to contact us to find out more about our monitoring and reporting services.

Every situation is different, but activities that tend to be flagged up with AML monitoring include large or frequent transactions, as well as payments that are inconsistent with the customer’s usual spending habits. Communications and transactions with sanctioned individuals and high-risk countries may also be flagged.

If a business fails to comply with AML checks and the regulations surrounding them, it can result in severe penalties such as large fines, reputational damage and criminal prosecution.

PEP screening is a process that refers to identifying politically exposed persons (PEP) - these people may pose a greater risk of money laundering or corruption (although being flagged as a PEP doesn’t necessarily mean the individual has committed a crime).

See our AML solutions in action

Want to discover the benefits that our award-winning AML solutions can bring to your business? Get in touch for…

- An effortless, fully integrated AML platform.

- A range of tailor-made solutions for several different sectors.

- A professional, trusted service.