Anti Money Laundering

Award-winning AML & KYC compliance for regulated businesses

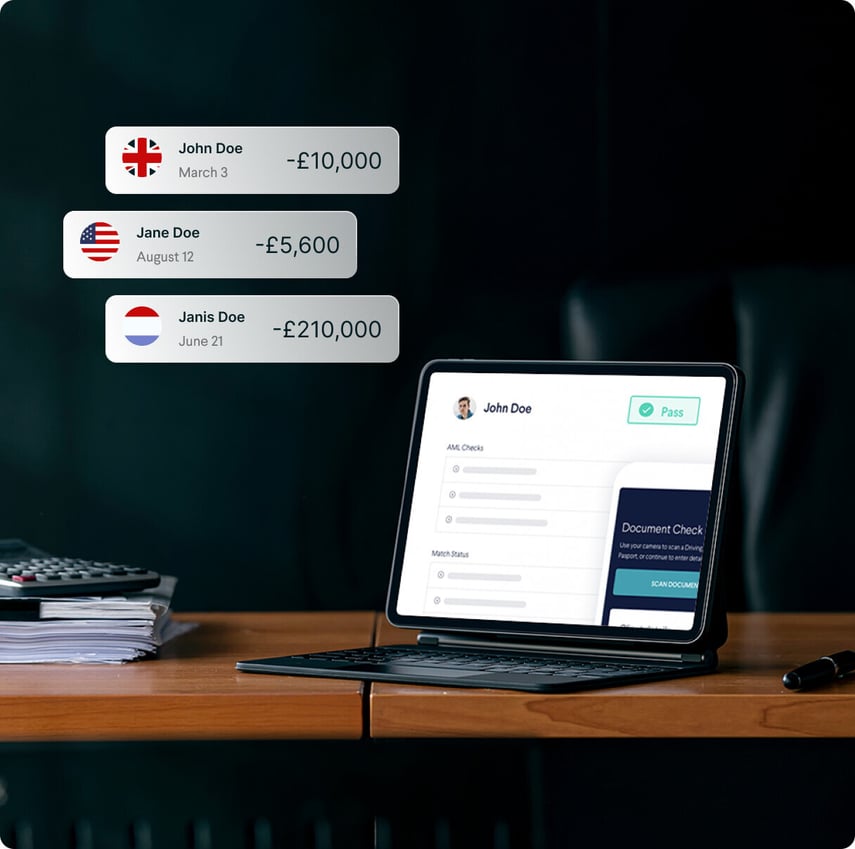

- Perform an individual AML check in less than 2 seconds

- Highest Pass Rate on the Market of up to 97%

- Run Sanctions & PEP Checks on Your New & Existing Clients

- International & Domestic Checks All in One Place

Driving the digital compliance revolution

End-to-End Solution

With our unique electronic platform, you can verify individuals and businesses, and perform screenings for Sanctions and PEPs, at the touch of a button.

Integrate SmartSearch's capabilities

We offer full API integration saving you time & money and making AML compliance easier than ever.

Quick & Accurate Results

Our platform works in real-time, completing AML checks in a matter of seconds, automatically triggers any Sanction or PEPs.

See it in action

Let one of our highly-trained sales team demonstrate the multi-award winning SmartSearch AML product.

/SmartSearch_OfficeLifestyle_Feb25_115-1.jpg?width=950&height=950&name=SmartSearch_OfficeLifestyle_Feb25_115-1.jpg)

Meet your compliance obligations and drive cost savings for your business, all in one easy-to-use AML platform

/SmartSearch_OfficeLifestyle_Feb25_122.jpg?width=855&height=855&name=SmartSearch_OfficeLifestyle_Feb25_122.jpg)

Benefits of Using SmartSearch for AML Compliance

SmartSearch partners with best-of-breed data providers, offering unmatched match rates up to 97% for AML checks. With this comprehensive data coverage, you can be confident in your corporate screening and KYC processes.

SmartSearch consolidates all your AML, KYC, and corporate risk management activities in one user-friendly platform, allowing your teams to manage compliance from onboarding to ongoing monitoring.

Our AML and compliance solution is trusted by over 2,000 financial firms

.png?length=204&name=coop%20(2).png)

.png?length=204&name=Greystone%20(2).png)

In a constantly changing anti-money laundering compliance landscape it is fantastic to have SmartSearch’s expertise on hand.

Linda Barlow

Co-operative Governance Advisor

Using the Smart Search system has helped to keep admin timings down due to the simplicity and given it is an intuitive system. The new updates have definitely helped to make things even easier.

The IJ Team

Our need for SmartSearch has expanded, originally starting with UK Individual searches and then moving onto UK Business searches. This has assisted us in developing our processes for the better, streamlining and speeding up our onboarding journey.

Stephen Kitchen

Compliance Associate

Integrate SmartSearch’s capabilities into your own system

We know that combining SmartSearch technology with your own systems is beneficial for everyone. Our integration process can be fully complete in just 24 hours, so you can continue client onboarding with minimal disruption, and carry out AML checks using their existing data files. Integrating our capabilities with your own data saves you time and money, making AML compliance easier than ever.

.png?length=400&name=Advanced%20(2).png)

Advanced delivers robust, cutting-edge solutions for optimised business operations.

Alto Software offers a comprehensive cloud-based property management solution for estate agents.

Wealth Dynamix provides CLM solutions for wealth management.

Salesforce streamlines sales, marketing, and customer service with its CRM tools.

.png?length=400&name=worxinfo%20(2).png)

Worxinfo creates efficient, tailored data systems for organisations.

See it in action

Let one of our highly-trained AML experts demonstrate the multi-award winning SmartSearch AML and compliance product.

.png?length=400&name=Data%20Partmers%20(2).png)

%20(1).png?length=400&name=LSEG%20(3)%20(1).png)

.png?length=400&name=bsi%20(2).png)